SUPPORTING FINANCIAL WELLBEING

MyView PayNow: A financial wellbeing app built around pay

A recent Zellis financial wellness survey identified that many people struggle to make ends meet and require short-term assistance. To support such challenges, Zellis has introduced a new financial wellbeing app built around pay: MyView PayNow.

For the new service, Zellis has partnered with Wagestream, the world’s most widely used financial wellbeing platform, to make work more rewarding for our clients’ workforces.

Through the mobile MyView PayNow app, employees will have access to tools designed to improve their financial wellbeing, all built around their pay. They can manage budgeting, choose when to get paid (also known as flexible pay), build up a rainy-day fund, get free financial information, and useful tools including a Benefits Checker.

In addition to gaining access to earned wages, users also benefit from financial tools and information to build good financial habits.

The MyView PayNow app is available from the Apple App Store and the Google Play Store.

The positive difference flexible pay makes for employees

*According to research conducted by WageStream

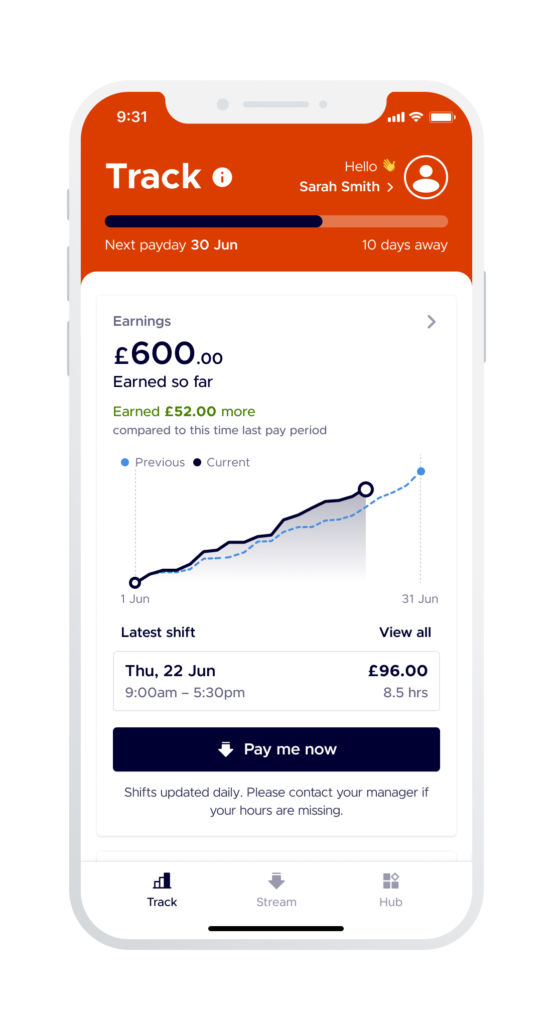

Track – pay and spend budgeting tool

Provide employees with live visibility over their pay and spending in one place, making it easier to budget with a single view of worked shifts, expected pay, and bank transactions.

- Visibility of worked and upcoming shifts in real time to ensure income is maintained at the right level for any upcoming spend.

- Match spending with income to help eliminate cashflow issues even when income fluctuates by connecting bank accounts using Open Banking.

- Real-time countdown to the next expected payday to help with budgeting.

Flexible pay

Providing employees access to their pay as they earn it (sometimes called Earned Wage Access) can reduce their reliance on loans and high-interest borrowing. Employees with fluctuating earnings (hourly paid workers) can smooth out fluctuations between pay periods and reduce potential cashflow problems

- Employees can access up to 50% of earnings that they are estimated to have earned to date.

- A fixed transaction fee of £1.95 – no interest is paid.

- Transfers instantly – no waiting for payments to clear.

Build – to improve financial resilience

With over a third (35%) of people in the UK having less than £100 in savings, Build makes it easy to put money away for a rainy day or for a specific life goal. Once employees set a build goal and a deadline, Build calculates the monthly contribution and automatically moves it to their build pot on payday.

- Auto-build from pay designed to “set and forget” and build a rainy-day pot over time

- Instant access to a rainy-day pot which can be transferred any time, for free

- Monthly prize draw to incentivise good money management.

- Save up to £1,000 overall – up to £100 per month

Financial health tools and information

- Includes a one-stop benefits checker that looks at hundreds of benefits, grants, and social tariffs

- Wide coverage across central and regional government, as well as local authorities.

- Signposting to applications, resources, and where to find additional support.

- Financial wellbeing quiz to benchmark progress and assess areas to improve.

What our customers think

Halfords

“We partnered with Wagestream to roll out a financial wellbeing programme that’s backed by leading charities and proven by data to improve quality of life. We’re proud to be the UK’s first listed retailer taking this step and excited to see the positive impact it will have on all our colleagues.”

Bupa

“We surveyed users within a month of having the system launched, and we noted a reduction in financial stress, a reduction in being distracted at work, and a reduction in people using payday loans or overdraft facilities. It really does cut across demographics, which is fantastic.”

The White Company

“From a business perspective, we know financial stress is a huge distraction for anyone If that’s hanging over you, you can’t be your best self in the workplace. This in turn affects the people profit chain and you simply can’t ignore these things. This is absolutely the right thing to do.”