PAY IN SECONDS, NOT DAYS

Zellis Faster Payments

We live in a world where people expect everything to be instant. In our personal lives, we have digital access to our funds 24/7/365 via our smartphones, letting us make payments anytime, from anywhere.

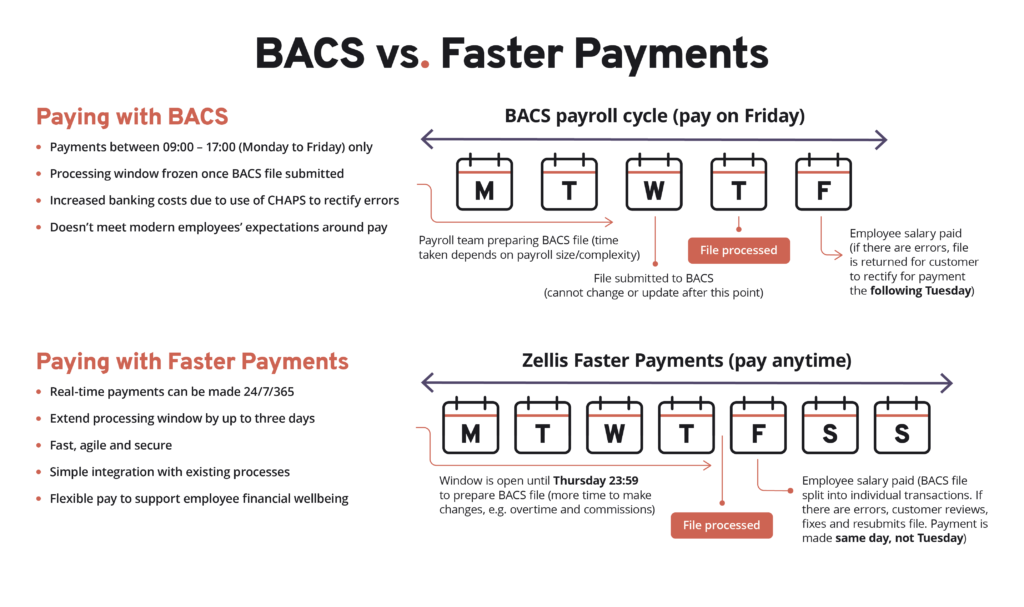

Payroll payments, however, are still typically made through the traditional BACS process, which can take up to three days.

With our new Faster Payments solution, it takes seconds to make payments, rather than days – giving you a little breathing space to ensure that your employees are paid accurately and on-time.

Why Faster Payments?

At Zellis, we’re focused on driving innovation to meet the increasing demand for a quicker, cost-effective and more flexible approach to payroll from business and their employees alike.

By using Faster Payments, we can help enhance the financial and mental wellbeing of your employees, while at the same time removing the complexity and latency associated with traditional processes.

This is especially beneficial to those organisations that are constantly racing against the clock to complete weekly payrolls with a limited input window, often covering a large mix of contingent and gig workers.

“Faster Payments is a key element of our vision to build a real-time and data-driven payroll solution that meets the needs of modern organisations.”

John Petter, CEO, Zellis

Payroll, reimagined

Faster Payments brings a whole host of benefits to your organisation:

Pay instantly, whenever you need to

Available to use 24/7, 365 days a year, Faster Payments lets you process your payroll whenever you need to. Gone are the days of Monday-Friday timetables, with the stress of early payments due to weekend pay dates. Plus, avoid any penalties associated with late payments.

Make accurate payments, every time

Removing the BACS process extends the payroll deadline by a minimum of two days, giving you more time to process last-minute changes, conduct additional report checking, and correct data. The result? A more accurate payroll, every time.

Cut costs and take back more time

Running a more accurate payroll reduces your need to rectify costly errors such as over- and underpayments using the expensive CHAPS process. Instead, take back time to focus on more strategic tasks and feel confident that payroll is supporting healthy cash flow in your organisation.

Reduce your compliance risk

The overall decrease in payroll mistakes reduces the risk of reputational and financial damage to your organisation. This includes the risk of employment law regulation breaches, such as National Minimum and Living Wage.

Deliver exceptional employee experiences

Providing your employees with more reliable and accurate payments helps to support employee motivation and retention. It also helps to protect the financial wellbeing of certain employees that need to be paid more frequently, such as shift and gig workers.